Share This Article

E stamping is changing the way Indians handle legal documents — and if you’ve signed a rental agreement, property deal, or loan document recently, you’ve likely encountered it already.

Yet most people don’t fully understand what e stamping actually is, how to get one, or whether their document is legally valid without it. This guide answers all of that — clearly, completely, and with no fluff.

What Is E Stamping? (Clear Definition)

E stamping (electronic stamping) is a computer-based method of paying stamp duty to the government on legal and financial documents. It was introduced in India by the Stock Holding Corporation of India Ltd (SHCIL) under authorization from the Central Record Keeping Agency (CRA).

Instead of buying a physical stamp paper from a vendor — which was prone to counterfeiting — you generate a Stamp Certificate with a Unique Identification Number (UIN). This certificate is tamper-proof, traceable, and legally valid under the Indian Stamp Act, 1899.

Think of e stamp as your government receipt for paying stamp duty — just fully digital and fraud-proof.

Why E Stamping Was Introduced in India

Traditional stamp papers had a major problem: fake stamp paper rackets. The infamous Abdul Karim Telgi scam (2003) exposed how billions of rupees in counterfeit stamp papers were circulated across India.

E stamping was the government’s direct response — a tamper-proof, centrally tracked system. Since its pilot launch in 2008 in Karnataka, it has expanded to over 20 Indian states and union territories as of 2026.

Who Needs E Stamping?

E stamping is required for almost any document that attracts stamp duty under Indian law. This includes:

- Rental and lease agreements

- Property sale deeds

- Loan or mortgage documents

- Partnership deeds

- Power of attorney documents

- Affidavits and indemnity bonds

- Share transfer documents

- Insurance policies

Who this is for: Property buyers and sellers, tenants and landlords, business owners, legal professionals, banks and NBFCs, and anyone executing a legally binding document.

Who can skip it: If your document doesn’t attract stamp duty under your state’s schedule (e.g., certain internal office letters, personal notes), you don’t need e stamping.

States Where E Stamping Is Available in India (2026)

SHCIL operates the e stamping system in partnership with state governments. States with active e stamping as of 2026 include:

| State / UT | Available |

|---|---|

| Delhi | ✅ Yes |

| Maharashtra | ✅ Yes |

| Karnataka | ✅ Yes |

| Gujarat | ✅ Yes |

| Uttar Pradesh | ✅ Yes |

| Rajasthan | ✅ Yes |

| Tamil Nadu | ✅ Yes |

| West Bengal | ✅ Yes |

| Himachal Pradesh | ✅ Yes |

| Uttarakhand | ✅ Yes |

States like Andhra Pradesh, Telangana, and Kerala operate their own state-run e stamping or franking portals, which are separate from SHCIL but equally valid.

Always verify availability in your specific district, as rollout varies even within states.

How E Stamping Works: Step-by-Step Process

Step 1: Identify the Correct Stamp Duty Amount

Before anything else, calculate the stamp duty applicable to your document type and value. Each state has its own stamp duty schedule — for example, Maharashtra charges 0.25% of annual rent for rental agreements below 5 years.

Step 2: Visit an Authorized Collection Center (ACC)

Go to a SHCIL branch, authorized bank, or sub-registrar office that accepts e stamp duty payment. You can find your nearest ACC at shcilestamp.com.

Step 3: Fill the Application Form

Provide:

- Names of all parties involved

- Document type (e.g., lease deed, sale deed)

- Stamp duty amount

- First party’s address and ID proof (Aadhaar, PAN)

Step 4: Pay the Stamp Duty

Payment can be made via:

- Cash (at physical ACCs)

- Demand draft

- NEFT/RTGS

- Online via SHCIL portal (in select states)

Step 5: Receive the E Stamp Certificate

Once payment is processed, you receive a printed E Stamp Certificate containing:

- A unique Certificate Number / UIN

- QR code and barcode

- Amount paid

- Date of issue

- Issuing authority details

Step 6: Execute Your Document on or Below the E Stamp

The legal document is then typed or written on the e stamp paper (or attached to it), signed by all parties, and if required, registered at the sub-registrar’s office.

How to Verify an E Stamp Certificate (Very Important)

Anyone can verify an e stamp certificate’s authenticity online at shcilestamp.com using the Certificate Number. This is one of the strongest anti-fraud features of the system.

Steps to verify:

- Go to shcilestamp.com

- Click “Verify Stamp Certificate”

- Enter the UIN/Certificate Number and state

- View document details instantly

Always verify before signing any document — especially in property or high-value transactions.

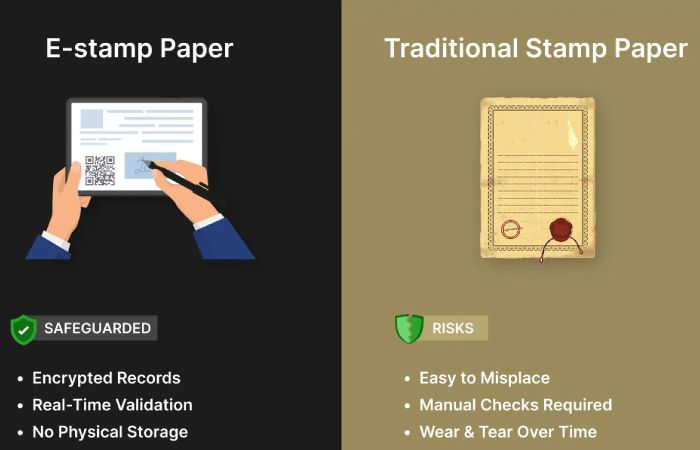

E Stamping vs Traditional Stamp Paper: Key Differences

| Feature | E Stamp | Traditional Stamp Paper |

|---|---|---|

| Fraud risk | Very low (traceable) | High (counterfeiting possible) |

| Availability | Online + ACCs | Stamp vendors only |

| Verification | Instant online | Not possible |

| Cost accuracy | Exact denomination | Limited denominations |

| Validity | No expiry | Can expire or be misused |

| Convenience | Higher | Lower |

Cost of E Stamping

The e stamp certificate itself typically carries a nominal service charge of ₹10 to ₹100 over and above the actual stamp duty amount, depending on the state and the issuing center.

The stamp duty itself varies by:

- Document type (rental vs. sale vs. loan)

- Transaction value

- State laws

For example:

- Delhi rental agreement (11 months): stamp duty = ₹50

- Maharashtra property sale deed: stamp duty = 5–6% of property value

- Karnataka lease deed (1 year): stamp duty = 0.5% of annual rent

Common Mistakes People Make With E Stamping

1. Wrong stamp duty amount Underpaying stamp duty can make your document legally unenforceable or attract a penalty of up to 10 times the deficit amount in some states.

2. Wrong document description The document type entered at the time of e stamp purchase must match the actual document being executed.

3. Using one e stamp for multiple documents Each e stamp certificate is valid for one document only.

4. Not registering when required E stamping and registration are two different things. For property transactions above certain thresholds, registration at the sub-registrar’s office is mandatory even after e stamping.

5. Buying from unauthorized sellers E stamps must be purchased only from SHCIL-authorized centers, not from random agents or brokers.

Myths vs Facts About E Stamping

| Myth | Fact |

|---|---|

| E stamp is only for big property deals | It’s used for rental agreements, affidavits, loan docs too |

| E stamp means the document is registered | Registration is a separate legal step |

| All states offer online e stamping | Physical ACCs are still required in many states |

| Old stamp papers are now illegal | They’re valid if purchased when legally available |

| E stamping is complicated | The process takes 15–30 minutes at an ACC |

E Stamping for Rental Agreements: A Practical Example

Riya is a working professional in Bengaluru renting a 2BHK for ₹25,000/month on an 11-month lease.

Her stamp duty: 0.5% × (₹25,000 × 12) = ₹1,500

She visits a SHCIL ACC near her, fills the form with landlord and tenant details, pays ₹1,500 + ₹10 service charge, and receives an e stamp certificate in 20 minutes.

The rental agreement is typed on paper referencing the e stamp certificate number, signed by both parties and two witnesses — and it’s legally valid.

Total time: under 1 hour. No fake stamp paper risk. No middlemen.

Safety & Legal Considerations

- E stamp certificates cannot be reused once a document is executed on them.

- Always keep the original e stamp certificate safe — it’s your proof of stamp duty payment.

- In disputes, courts recognize e stamp certificates as legally valid evidence.

- Stamp duty evasion is a civil and criminal offense under the Indian Stamp Act.

FAQs About E Stamping

Q1. Is e stamping legally valid in India? Yes. E stamping is fully valid under the Indian Stamp Act, 1899, and is recognized by courts, banks, and government authorities across India.

Q2. Can I get an e stamp online without visiting a center? In some states like Delhi and Gujarat, partial online application is available, but physical stamp certificate collection or printing is still required at an ACC in most cases.

Q3. What is the validity of an e stamp certificate? E stamp certificates do not have a strict expiry, but documents executed on them should be registered (if required) within the legally prescribed time to avoid penalties.

Q4. What if I paid the wrong stamp duty amount? You must pay the deficit amount along with applicable penalty before the document can be legally used. Consult a legal professional immediately.

Q5. Can e stamp certificates be cancelled or refunded? Yes, but the process varies by state. Unused e stamp certificates can generally be surrendered at the issuing ACC for a refund, subject to deductions.

Q6. What documents do I need to get an e stamp? Typically: Aadhaar card or PAN card of the first party, details of all parties, document type, and transaction value.

Q7. Is e stamping available for NRIs? Yes, NRIs can execute e stamped documents through authorized representatives or power of attorney holders in India.

Final Conclusion

E stamping has made one of India’s most important legal processes faster, safer, and more transparent. Whether you’re signing a rental agreement in Delhi, executing a sale deed in Pune, or creating a partnership deed in Bengaluru — e stamping ensures your stamp duty payment is genuine, traceable, and legally airtight.

The days of hunting for stamp paper vendors or worrying about counterfeit documents are over. With SHCIL’s network of authorized centers and growing online access, getting an e stamp in 2026 is a matter of minutes — not days.

Understand the process, pay the right duty, verify your certificate, and your document stands on solid legal ground.